The Nuburu financing framework developed in partnership with Liqueous LP is revolutionizing how high-growth companies raise capital while protecting their investors. This innovative financing strategy is designed to minimize dilution for shareholders, a key concern for anyone investing in companies aiming for rapid expansion. By structuring capital raises to avoid toxic financing practices, Nuburu ensures that its existing shareholders maintain their value as the company continues to grow.

Understanding Nuburu’s Financing Approach

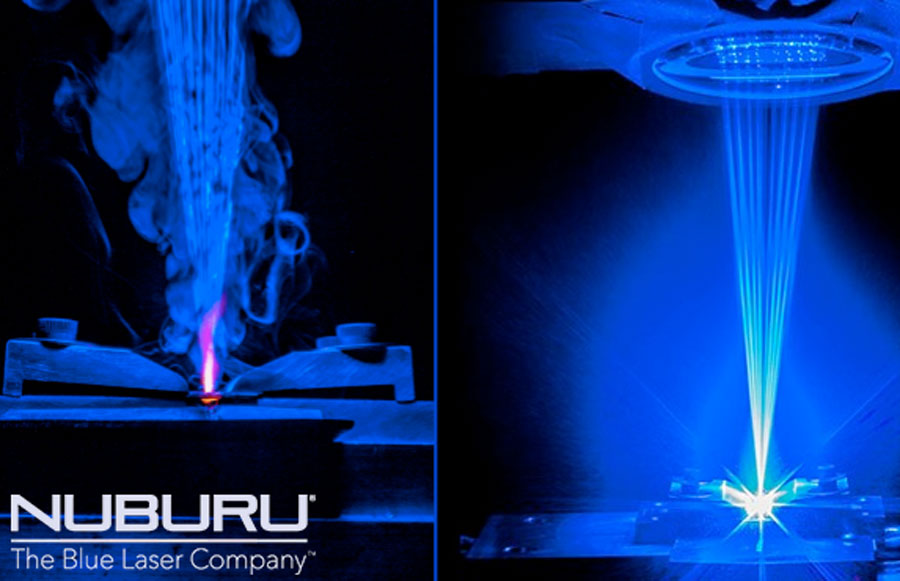

Nuburu is a leader in blue laser technology and is expanding its reach into critical sectors such as aerospace, defense, and advanced manufacturing. To fuel this expansion, Nuburu has crafted a financing model that aligns with the interests of its investors.

The Nuburu financing framework is specifically designed to mitigate the risks associated with heavy dilution that often accompanies traditional equity raises. Unlike many companies that issue new shares, which can diminish existing shareholders’ ownership percentages, Nuburu’s approach protects shareholder value by minimizing new equity issuance.

Minimal Dilution and Shareholder Value Preservation

A significant concern for investors in high-growth sectors is the threat of heavy dilution through capital raises. The Nuburu financing framework addresses this by strategically limiting the issuance of additional shares, allowing investors to preserve their ownership stake.

By avoiding toxic financing methods that could lead to resets in share value or increased vulnerability, Nuburu provides a solid foundation for shareholder value preservation. This strategy not only reassures current investors but also attracts new capital without compromising their interests.

The Benefits of Non-Toxic Financing for Nuburu’s Future

The concept of non-toxic financing is crucial to Nuburu’s financial strategy. It allows the company to raise capital without engaging in practices that could destabilize its stock price or reduce investor confidence. Through the Nuburu financing framework, the partnership with Liqueous LP is structured to provide the necessary funds for growth while maintaining the integrity of shareholder investments.

This sustainable financial model enables Nuburu to raise capital as needed, fostering a stable environment for both the company and its investors. By avoiding heavy dilution, Nuburu ensures that it can continue to innovate and lead in blue laser technology, while its shareholders benefit from the company’s ongoing success.

Investor Confidence and Long-Term Growth

The Nuburu financing framework showcases the company’s commitment to maintaining investor confidence. As Nuburu moves forward in its mission to innovate and expand, this framework serves as a reassurance to investors that their interests are being prioritized.

By structuring capital raises to minimize dilution, Nuburu reinforces its dedication to preserving shareholder value. This fosters trust among investors, ensuring they feel secure in their stakes as the company grows and evolves in the competitive landscape.

Capital for Growth Without Compromise

In sectors like advanced manufacturing and defense technologies, access to capital is vital for progress. The Nuburu financing framework allows the company to raise the necessary funds without resorting to methods that would negatively impact its investors.

By partnering with Liqueous LP, Nuburu can secure non-dilutive capital that supports its long-term goals while safeguarding its shareholders’ investments. This strategy exemplifies Nuburu’s ability to balance growth with responsible financial practices, ensuring that it remains a strong contender in its industry.

Conclusion

The Nuburu financing framework with Liqueous LP is an exemplary model of how high-growth companies can successfully navigate the complexities of capital raising while prioritizing investor protection. By focusing on minimal dilution and non-toxic financing practices, Nuburu is positioned to continue its growth trajectory without compromising the value of its shareholders’ investments.

As Nuburu advances in its mission to innovate within the blue laser technology sector, this financial strategy not only solidifies its market position but also enhances investor confidence. For investors seeking opportunities in high-growth companies, Nuburu’s approach presents a compelling case for minimal risk and substantial long-term benefits.