The oil market rises as US sanctions on Iran and Russia counter global glut concerns. Brent crude gains 3.5% this week.

The global oil market is poised for its first weekly gain in three weeks, driven by the possibility of tighter US sanctions against Iran and Russia. These developments have helped offset ongoing concerns about an expected global oil glut in 2025, according to market analysts and recent reports.

Brent Crude Gains as Oil Market Awaits Sanctions

Brent crude prices have held steady above $73 a barrel, showing a 3.5% rise this week. Meanwhile, West Texas Intermediate (WTI) crude hovered around $70, supported by bullish sentiment as geopolitical factors come into play. The potential for stricter sanctions has sparked increased activity in the oil market, particularly in options trading.

The Biden administration is considering imposing new sanctions on Russia’s oil trade as part of its ongoing measures to curb Moscow’s influence. Meanwhile, President-elect Donald Trump’s pick for national security adviser has pledged a return to the “maximum pressure” strategy on Iran, signaling potential disruptions in oil exports from two major players in the global oil market.

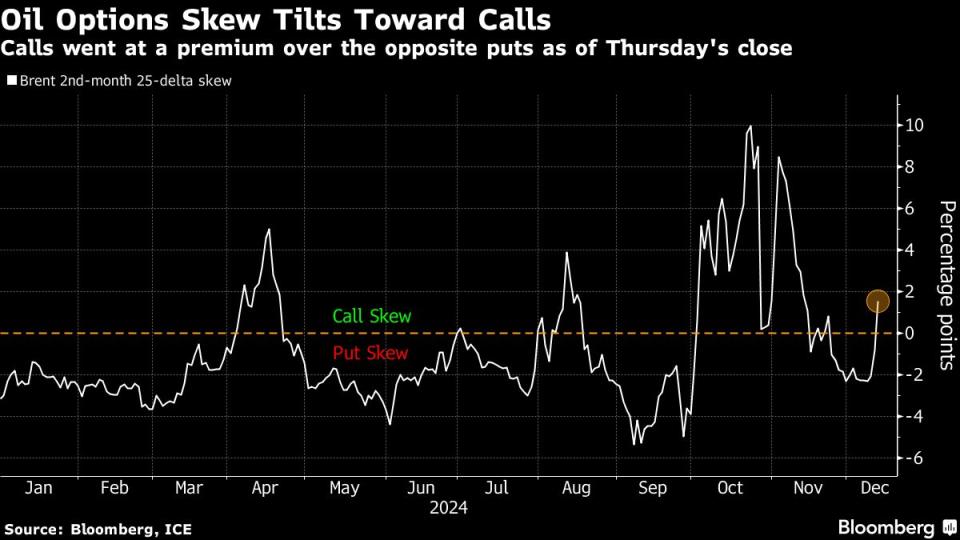

These geopolitical developments caused a noticeable spike in oil market activity. Options market skews for Brent and WTI showed a bias toward calls, reflecting expectations of price increases. Additionally, implied volatility in oil prices rose sharply as traders weighed the potential impact of sanctions.

Canada’s Export Tax Proposal Raises Oil Market Concerns

Adding another layer of complexity to the oil market, Canada is reportedly examining the use of export taxes on commodities such as uranium and oil. This move is seen as a response to President-elect Trump’s threats of sweeping tariffs on Canadian goods. While officials indicate that such measures would only be a last resort, the mere possibility has heightened market uncertainties.

Export taxes could disrupt oil trade between Canada and the US, potentially tightening supply and contributing to price volatility in the oil market. These measures, if implemented, would add further pressure to an already fragile global market.

OPEC+ Actions Fail to Alleviate Glut Concerns

Despite this week’s price increases, concerns about an impending global oil glut remain a dominant narrative. According to the International Energy Agency (IEA), global oil supply is expected to exceed demand significantly in 2025, raising fears of prolonged price pressures.

OPEC+ recently decided to delay the revival of idled oil supplies, a move intended to support prices. However, the impact of this decision appears limited, as the oil market continues to face challenges from weak demand growth and high inventory levels.

Market Sentiment Heading Into 2025

“Traders are hesitant to push prices lower heading into the year-end,” said Anindya Banerjee, head of commodity and currency research at Kotak Securities Ltd. in Mumbai. He noted that uncertainties surrounding US sanctions and geopolitical risks are preventing significant downward pressure on oil prices.

The oil market is expected to remain range-bound until President-elect Trump takes office in January, with traders closely monitoring developments around sanctions and trade policies.

Broader Implications for the Oil Market

The potential for tighter sanctions and export taxes underscores the growing influence of geopolitical factors on the oil market. These developments could have far-reaching implications, not just for prices but also for supply chains and global trade.

For instance, sanctions on Iran and Russia could disrupt major supply routes, leading to tighter global supplies and increased competition among buyers. Similarly, Canadian export taxes could strain trade relations with the US, potentially prompting retaliatory measures that further complicate the oil market landscape.

Moreover, the expected glut in 2025 highlights the challenges facing the industry as it seeks to balance supply and demand. With renewable energy sources gaining traction and economic uncertainties weighing on demand growth, the oil market faces a critical period of adjustment.

Conclusion

The oil market’s weekly gain reflects a mix of bullish sentiment driven by potential US sanctions and persistent concerns about future supply-demand imbalances. Brent crude and WTI prices have found support amid geopolitical developments, but the outlook remains clouded by looming oversupply and market volatility.

As the year draws to a close, traders and analysts will be closely watching policy decisions in the US and Canada, as well as actions by OPEC+ and other major players. The coming months will be crucial in shaping the trajectory of the global oil market as it navigates these complex challenges.