The Chinese stock market decline deepens as investors await Beijing’s policy briefing on fiscal stimulus. Will new measures revive the slowing economy?

The Chinese stock market decline worsened, with shares dropping significantly ahead of a crucial policy briefing that may reveal more about Beijing’s fiscal stimulus plans. Investors are growing cautious as they await clarity on China’s economic strategy, with the CSI 300 Index falling 2.4% in afternoon trading. This decline positions Chinese stocks as underperformers compared to their Asian peers, as market participants brace for potentially disappointing announcements.

Key Concerns Ahead of China’s Policy Briefing

All eyes are on the Chinese government’s upcoming Saturday briefing, where the finance minister is expected to announce measures aimed at revitalizing the country’s slowing economy. Experts are predicting as much as 2 trillion yuan ($283 billion) in new fiscal stimulus, but there is growing skepticism about whether the Ministry of Finance will approve additional budget allocations or a new bond quota. This uncertainty is driving the Chinese stock market decline as traders await more concrete details.

“The risk of another disappointment looms large. The Ministry of Finance does not control extra budget approval, so there’s uncertainty around whether the briefing can deliver new stimulus details,” noted Kieran Calder, head of equity research at Union Bancaire Privee.

Global Market Reactions and Fed Moves

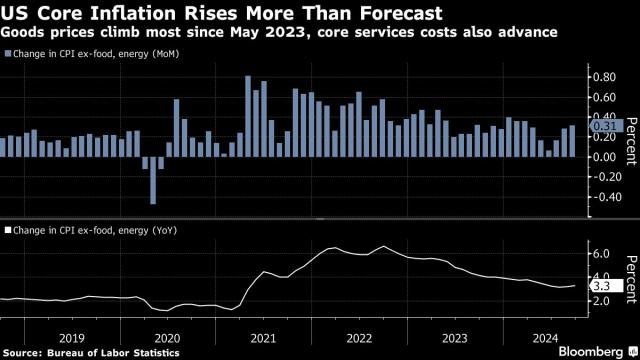

The ripple effects of the Chinese stock market decline are being felt across global markets. In the U.S., the S&P 500 fell by 0.2%, and the Nasdaq 100 slipped 0.1%, continuing a streak of losses triggered by inflation concerns and speculation on the Federal Reserve’s next move.

Treasuries also remained steady in early Asian trading after the two-year yield dropped by six basis points, and the 10-year yield fell by one basis point on Thursday. The U.S. Federal Reserve has acknowledged the growing difficulty of hitting its inflation target, with some market analysts predicting two rate cuts by the end of the year.

David Donabedian at CIBC Private Wealth US noted, “The Fed warned that the last stretch to reach their inflation goal will be tough, and we are now seeing that reflected in market reactions.”

Currency and Commodity Markets

The Chinese stock market decline had a noticeable impact on Asian currency markets, where the yen remained steady around 148 per U.S. dollar. South Korea’s won gained against the dollar, supported by the Bank of Korea’s decision to cut its key interest rate by 25 basis points to 3.25%. Meanwhile, the Australian dollar showed little movement, and the offshore yuan rose slightly to 7.0798 per dollar.

In the commodities sector, oil prices saw a slight decline after earlier gains. West Texas Intermediate crude dropped 0.3%, trading at $75.62 a barrel, as traders speculated on geopolitical risks tied to the ongoing conflict in the Middle East. Gold, a safe-haven asset in times of uncertainty, rose 0.6% to $2,644.79 per ounce.

Anticipation Builds for U.S. Bank Earnings

Investors are also keeping a close eye on the third-quarter earnings reports from major U.S. banks, including JPMorgan Chase & Co., Wells Fargo & Co., and Bank of New York Mellon Corp. Analysts will focus on JPMorgan’s net interest income, especially after the bank’s executives downplayed expectations for significant growth in this revenue stream.

For Wells Fargo, the market is looking for updates regarding its asset cap, while BNY Mellon is expected to report a 4% increase in revenue, its fastest growth in more than a year, according to Bloomberg Intelligence.

Broader Implications of the Chinese Stock Market Decline

The Chinese stock market decline is not happening in isolation. It reflects deeper concerns about the country’s economic future. China has been facing economic headwinds in recent months, including a property sector downturn, sluggish consumer demand, and an overall slowdown in growth. Analysts believe that if the weekend’s policy briefing fails to provide a clear path toward recovery, it could exacerbate market jitters, not just in China but globally.

Moreover, while investors are hopeful for new stimulus, there’s recognition that this might not be enough to offset long-term structural issues within the Chinese economy. The country’s transition from an export-led economy to one driven by domestic consumption has faced significant hurdles, particularly during the pandemic.

Outlook for Global Investors

As China’s policy briefing approaches, the global markets are treading cautiously. Investors are bracing for possible disappointments, but also holding out hope for significant fiscal stimulus that could spark a recovery. Any new economic measures from China will not only affect its own stock market but also have far-reaching implications for global growth.

For now, the Chinese stock market decline remains a focal point for traders around the world, reflecting broader concerns about inflation, economic growth, and global financial stability.

Conclusion

The Chinese stock market decline ahead of a critical policy briefing has investors on edge, with hopes hinging on Beijing’s fiscal stimulus measures to revitalize the economy. As the world awaits China’s next move, the broader financial markets are adjusting to the ongoing uncertainty, with global implications for currencies, commodities, and equities alike.

Key Events This Week:

- JPMorgan, Wells Fargo kick off Q3 earnings reports for major banks.

- U.S. Producer Price Index (PPI) and University of Michigan consumer sentiment data are due Friday.

- Speeches from Federal Reserve officials including Lorie Logan, Austan Goolsbee, and Michelle Bowman.

Market Overview:

- CSI 300: -2.4%

- S&P 500: -0.2%

- Nasdaq 100: -0.1%

- West Texas Intermediate crude: $75.62/barrel

- Gold: $2,644.79/ounce