China economy recovery shows promising growth as retail sales surge, boosted by Beijing’s stimulus measures, igniting optimism in the nation’s economic outlook.

China’s economy appears to be stabilizing, showing encouraging signs of recovery as retail sales surged at the fastest rate in eight months. This boost, especially within consumer spending, signals the effectiveness of Beijing’s recent stimulus measures to bolster critical sectors. Retail sales, an essential indicator of domestic consumption, rose 4.8% in October from the previous year, marking the highest growth since February. Although industrial output also rose by 5.3%, it slightly missed forecasts, underscoring mixed impacts across the sectors.

Economic analysts closely monitor these retail sales figures, which represent a substantial improvement in an area that has previously struggled. This uptick hints that policies aimed at stimulating domestic demand may be starting to work as intended. According to Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd., policymakers are likely encouraged by the retail sales growth, even if it accompanies slower growth in industrial production.

Retail Sales Surge Helps Drive China Economy Recovery

The Chinese government’s efforts to stimulate consumer spending have taken multiple forms, from subsidies for essential purchases to incentives for home appliances and vehicles. October saw sales of home appliances rise by a notable 39% year-over-year—the fastest increase in over a decade. Such growth indicates the success of Beijing’s strategy to promote consumer activity and stimulate the China economy recovery.

These measures, focused on the domestic economy, aim to balance China’s growth dynamics while reducing reliance on exports, which face rising uncertainties due to global trade tensions. The reelection of Donald Trump in the United States has raised the likelihood of new tariffs on Chinese imports, which could negatively affect China’s export sector. In this context, emphasizing internal demand through consumer spending has become even more crucial to China economy recovery.

Industrial Output Reflects China Economy Recovery and Growth

The latest data from the National Bureau of Statistics illustrate both the achievements and challenges of China’s economic strategies. While retail sales exhibit robust growth, industrial output remains slightly below projections, reflecting the broader two-speed economy in which consumption trails production, and external demand faces uncertainty.

The CSI 300 Index, a benchmark for onshore stocks, responded positively to the news, suggesting optimism about China economy recovery. Shares of Chinese companies listed in Hong Kong also saw gains, although tempered by ongoing industrial challenges and trade concerns.

Government Policies Enhance China Economy Recovery Efforts

China’s stimulus measures are part of the largest support effort since the pandemic, targeting an annual growth goal of 5%. The government has implemented interest-rate cuts and boosted support for the property and stock markets, aiming to stabilize sectors. Recently, a $1.4 trillion debt swap program was introduced to help local governments manage debt, allowing more fiscal flexibility to invest in growth initiatives.

However, the task remains complex. A recent slowdown in growth has spurred the Finance Minister, Lan Fo’an, to propose a “more forceful” fiscal approach in 2025, with plans to expand the budget deficit, increase local bond issuance, and support a cash-for-clunkers program. These steps reflect the government’s commitment to the China economy recovery through proactive fiscal policies.

Indicators Show Both Progress and Challenges for China Economy Recovery

Looking forward, the stability of China’s economic recovery will rely on domestic demand and global economic conditions. October’s data offered mixed signals: sentiment among manufacturers improved, and export growth reached a two-year high. However, inflation stayed close to zero, and credit growth slowed more than anticipated, indicating that domestic demand could be stronger.

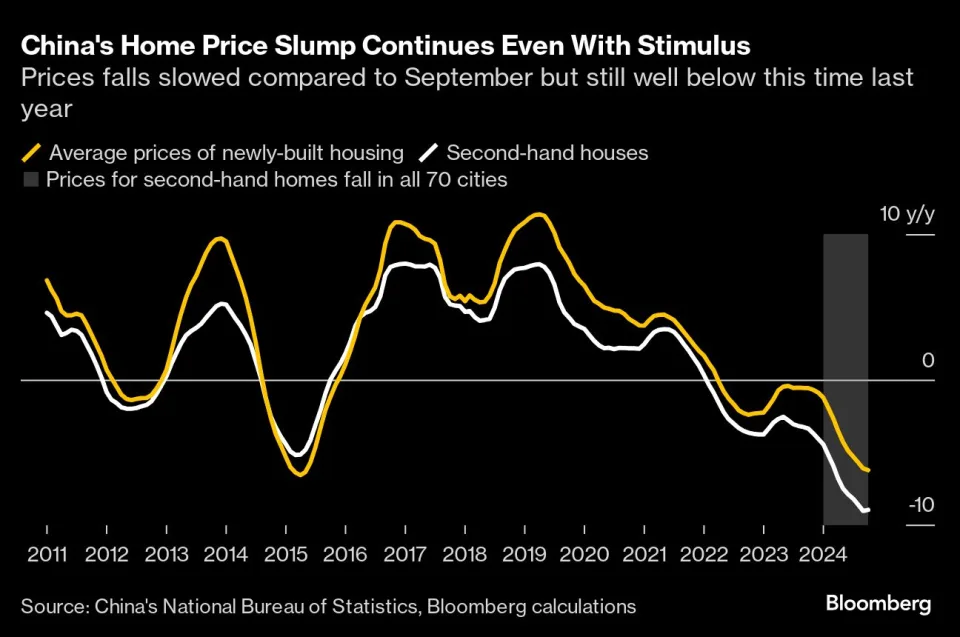

Beijing’s policies have begun to show positive impacts, as seen in slower home-price declines and improved housing sales. Property investment remains low, falling by 10.3% over the first ten months of the year. This trend points to cautious behavior among developers despite policy support.

The immediate challenge will be balancing support across various economic sectors. The focus on retail and consumer spending is yielding results, but industrial investment and real estate demand ongoing attention. Economists anticipate an increase in fiscal spending in the coming months, which may help support the China economy recovery.

China’s economic trajectory will likely remain complex, especially given the evolving global trade landscape. Nonetheless, the recent retail growth and ongoing support measures offer a promising indication that China economy recovery is taking hold, paving the way for potential growth in the coming year.