The French growth prospects for 2025 have been downgraded due to political instability and fiscal challenges. The ongoing uncertainty is clouding the country’s economic recovery.

French Growth Prospects Decline Amid Political Instability

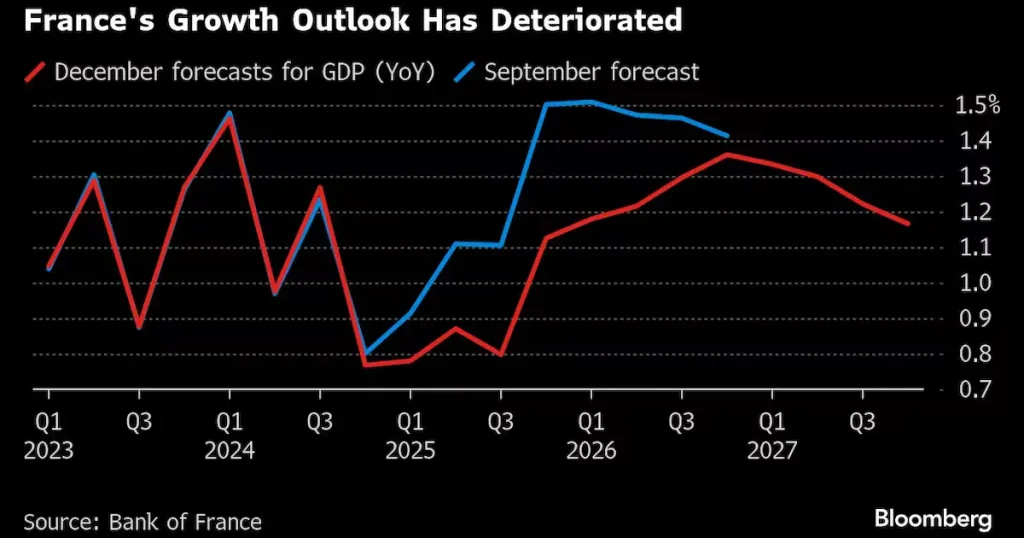

The French growth prospects have taken a significant downturn, with the Bank of France revising its forecast for 2025. Political upheaval continues to impact business and consumer confidence, leading to lower growth projections. In recent days, France’s central bank has warned that the country’s economic recovery is likely to be much slower than previously expected, casting a shadow over the nation’s economic future.

Bank of France Lowers French Growth Prospects for 2025

In a recent update, the Bank of France revised its growth expectations for 2025 down to 0.9%, citing political uncertainty as a key factor. The central bank had initially predicted a 1.2% expansion in September. Additionally, the forecast for 2026 was revised downward by 0.2 percentage points to 1.3%. These revisions highlight concerns about the French growth prospects, especially given the country’s ongoing political and fiscal challenges.

The central bank’s officials have also pointed to a lack of investor confidence as a primary reason behind the downgrade. A stable political environment is crucial to maintaining economic growth, and the uncertainty stemming from the government’s instability is having a direct impact on the country’s future economic outlook.

Impact of Political Crisis on French Growth Prospects

The French growth prospects are further undermined by the ongoing political crisis, which began with snap elections in June and escalated in December. In the midst of growing public dissatisfaction, President Emmanuel Macron appointed his fourth prime minister of the year, centrist François Bayrou, in an attempt to stabilize the government. However, Bayrou’s appointment has yet to provide a clear solution to the political paralysis facing the country.

In recent weeks, the French political landscape has become even more fragmented, with sharp divisions between political parties. These divisions have created a significant roadblock to passing the necessary budgetary reforms. The French growth prospects remain uncertain as the government struggles to implement policies that can address the rising public debt, growing deficit, and the widening gap between government spending and revenue.

Political Instability Clouds the Future of French Growth Prospects

The ongoing instability has severely impacted public trust, with many citizens expressing disillusionment over the country’s economic leadership. Prime Minister Bayrou is tasked with addressing the country’s growing fiscal problems, including the need for sweeping budget cuts and measures to reduce the national deficit. However, the French growth prospects are bleak unless the country’s political leaders can find a way to work together and pass an effective fiscal plan.

Despite attempts to hold discussions with various political factions, including left-wing parties and far-right leaders like Marine Le Pen, Bayrou faces enormous challenges in securing a majority in the National Assembly. Without significant political compromise, it is unclear how France will resolve its fiscal issues and restore confidence among investors. These challenges continue to weigh heavily on the French growth prospects for 2025 and beyond.

Bank of France Warns of Continued Strain on French Growth Prospects

The Bank of France’s revised forecasts show the country’s fiscal challenges are deepening, with emergency legislation required to maintain basic government functions into the new year. The French growth prospects could be further impacted if the government fails to present a full budget plan by early 2025. As it stands, France is relying on temporary measures to prevent the economy from stalling, which adds uncertainty to the country’s long-term outlook.

Bank officials have cautioned that failing to address the country’s fiscal challenges could lead to even more severe consequences. With investor confidence waning, borrowing costs have already risen, and France’s credit rating was downgraded by Moody’s Ratings over the weekend, signaling growing concerns over the country’s financial health.

Fiscal Uncertainty Weighs on French Growth Prospects and Business Confidence

The ongoing political and fiscal uncertainty has had a direct impact on French businesses, with many companies holding off on investment plans and hiring initiatives. The French growth prospects depend heavily on business confidence, which is at an all-time low due to the persistent political chaos. Engie Chairman Jean-Pierre Clamadieu, in a recent interview, expressed concern over the situation, emphasizing the urgent need for political stability to help revive the country’s economic prospects.

This uncertainty has also been felt in the bond market, where the spread between French and German debt has risen to a 12-year high. While the yield spread has slightly eased, it remains a significant indicator of investor caution. For France’s growth prospects, this indicates that investors are becoming increasingly wary of the country’s ability to manage its finances and maintain economic stability.

French Growth Prospects Under Pressure From Political and Economic Challenges

The French growth prospects are facing immense pressure from both political instability and economic factors. Falling orders, frozen investment, and a decline in business confidence are all contributing to the country’s current economic slowdown. With little political consensus, the government’s ability to implement the necessary reforms remains highly uncertain.

As business leaders continue to express concern, they are hoping that more political clarity will emerge in the coming weeks. For France’s growth prospects, a return to political stability and fiscal responsibility is critical to restoring investor confidence and stimulating economic recovery. Until these conditions are met, France’s economy is likely to remain in a state of limbo.