Samsung stock surges 8.6% Friday, reaching a four-year high after months of losses. Investors eye valuation appeal amid trade risks and AI concerns.

Samsung stock surged on Friday, delivering its most impressive single-day rally since January 2021. Shares of Samsung Electronics Co., the global leader in memory chips and smartphones, climbed 8.6%. This rally ends a five-day losing streak, fueled by investors’ belief that the tech giant is undervalued after months of underperformance.

Despite this remarkable rebound, Samsung stock is down 32% year-to-date. Persistent concerns over lagging competitiveness in artificial intelligence (AI), trade risks, and a weak memory chip market cloud the outlook for this South Korean tech giant.

Factors Behind Samsung Stock’s Rally

Bargain Valuations Attract Buyers

The most significant driver behind Samsung stock’s sharp rise is its undervaluation. Earlier this week, the stock dipped below the 50,000 won ($35.70) threshold—a key psychological level for South Korean retail investors. Analysts at Daiwa Securities described the recovery as a “technical rebound,” restoring investor confidence and sparking buying activity.

According to Bloomberg, Samsung stock trades at a discount of over 10% to its one-year forward book value. This valuation disparity has made the stock particularly appealing to bargain hunters seeking opportunities in the tech sector.

Technical Momentum Amplifies Gains

In addition to valuation-driven interest, Friday’s surge was fueled by technical factors. The stock’s rebound from the 50,000-won support level triggered momentum-driven buying, amplifying gains further. Analysts noted that oversold conditions in the preceding weeks set the stage for this recovery, as short-term traders capitalized on the opportunity.

Challenges That Could Impact Samsung Stock

Geopolitical Risks and Trade Policies

Despite Friday’s rally, Samsung stock faces several challenges that could hinder sustained growth. Geopolitical risks, particularly those tied to potential protectionist trade policies in the United States, remain a significant concern. The possibility of tariffs or export restrictions could disrupt Samsung’s global supply chain and impact its bottom line.

Donald Trump’s potential return to power has reignited fears of a more aggressive stance on trade, especially regarding South Korea’s export-heavy economy. These uncertainties weigh heavily on Samsung stock, despite its current upward momentum.

Falling Behind in AI Development

Samsung’s slower progress in artificial intelligence (AI) development is another area of concern. As competitors like NVIDIA and Taiwan Semiconductor Manufacturing Company (TSMC) advance rapidly in AI-driven technologies, Samsung risks falling behind in this critical sector.

AI is increasingly integral to consumer electronics and semiconductor markets, making it essential for Samsung to accelerate its innovation. Failing to do so could limit the long-term growth potential of Samsung stock.

Weakness in Memory Markets

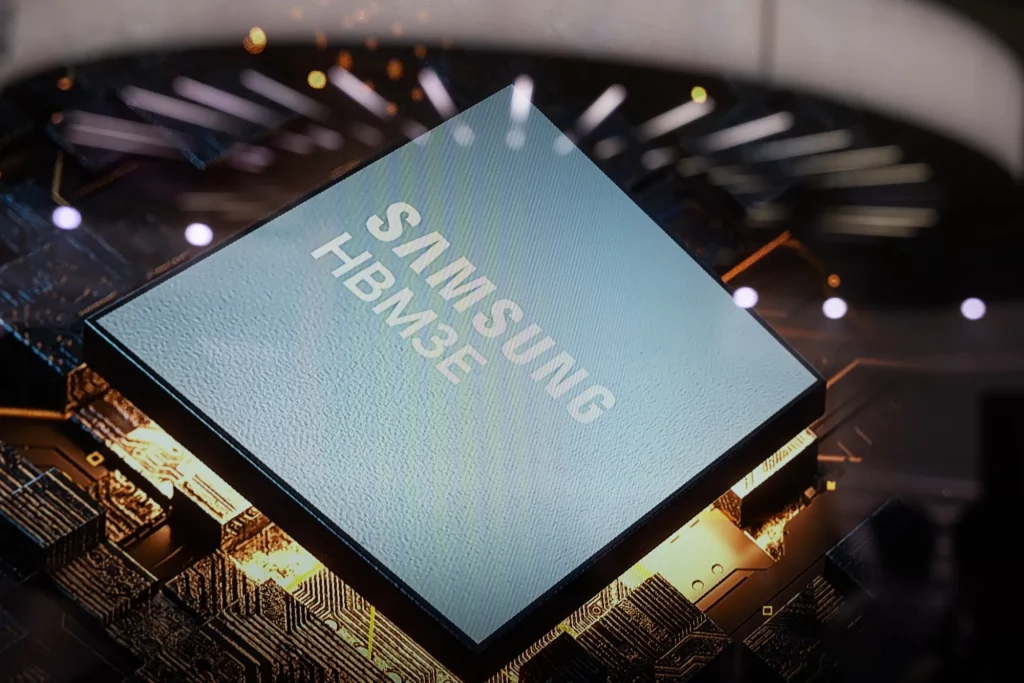

The global memory chip market, a cornerstone of Samsung’s business, remains under pressure. Demand for high-bandwidth memory (HBM) chips is growing, but Samsung is facing stiff competition and delays in scaling its production capabilities.

Sat Duhra, a fund manager at Janus Henderson Group, highlighted these challenges, stating, “The lower valuation of Samsung stock is justified given trade risks, the HBM catch-up timeline, and the weak memory environment. Investors may find better opportunities in Taiwan’s tech sector.”

Samsung Stock’s Long-Term Outlook

As of Friday afternoon, Samsung stock was trading at 53,800 won, well above the critical 50,000-won support level. While the rebound is promising, analysts caution that sustaining these gains will depend on Samsung’s ability to address its strategic weaknesses.

Addressing AI and Semiconductor Challenges

For Samsung stock to maintain its upward trajectory, the company must prioritize advancements in AI and semiconductor technologies. This includes investing in R&D to close the gap with competitors and capturing a larger share of the high-growth AI market.

Samsung’s success in scaling its HBM chip production and adapting to evolving industry trends will be critical in restoring investor confidence. A stronger foothold in these areas could position Samsung stock for sustained growth.

Mitigating Trade and Geopolitical Risks

Navigating trade-related challenges is equally important. Samsung will need to strengthen its global supply chain and diversify its markets to mitigate the impact of potential tariffs or export restrictions. Collaborating with key stakeholders and leveraging its leadership in memory chips and smartphones could help the company weather geopolitical uncertainties.

Broader Implications for the Market

Impact on South Korea’s Economy

As South Korea’s largest company, Samsung plays a pivotal role in the nation’s economy. The recent rally in Samsung stock has broader implications for the KOSPI index, where Samsung is a dominant component. A sustained recovery could boost market sentiment and attract foreign investment into South Korea’s stock market.

Opportunities for Retail and Institutional Investors

For investors, the current valuation of Samsung stock presents both risks and opportunities. Retail investors may view the rebound as a chance to capitalize on short-term gains, while institutional investors could adopt a more cautious approach, focusing on long-term fundamentals.

Investor Sentiment and Recommendations

Friday’s rally has rekindled interest in Samsung stock, but analysts urge caution. Daiwa Securities emphasized that the surge is primarily a technical recovery rather than a fundamental shift.

For long-term investors, Samsung’s ability to adapt to global trends and address its strategic challenges will be the key to sustainable growth. While risks remain, the company’s strong market position and leadership in memory chips and smartphones make Samsung stock a compelling option for those with a high-risk tolerance.economy and a key player in the global tech industry. For long-term investors, Samsung stock offers a blend of risks and opportunities, reflecting its pivotal role in shaping the technology sector.